How govs spent $50bn excess crude funds – NESG

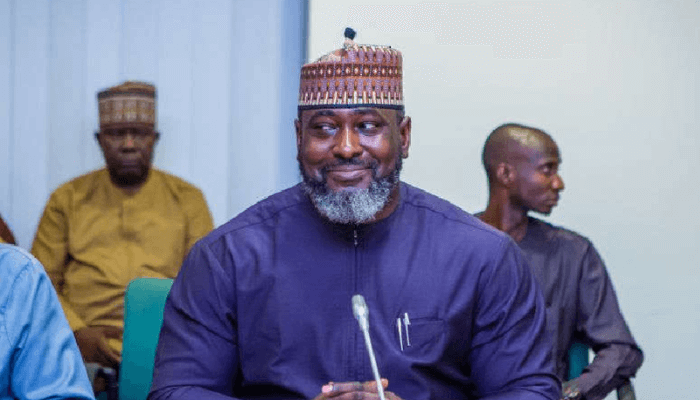

Chairman and Chief Executive Officer of Nigeria Economic Summit Group, Dr. Tayo Aduloju

The Nigerian Economic Summit Group has explained how state governors spent the country’s $50bn Excess Crude Account in 2010, which would have served as a buffer for subsidies and other pressing financial concerns of the nation.

The Chief Executive Officer of NESG, Dr Tayo Aduloju, disclosed this during a courtesy visit to the headquarters of PUNCH Nigeria Limited on Wednesday.

He recalled that the global financial crisis of 2007 and 2008 had minimal effects on Nigerian firms because the country had a substantial fiscal buffer in the ECA, which greatly shielded it from external economic shocks.

However, in 2010, the state governors approached the Supreme Court to declare the ECA illegal, giving them the basis to share the funds domiciled in the account.

According to him, the Federal Government disbursed the $50bn fund to the 36 state governors between when late President Umaru Musa Yar’Adua died and when former President Goodluck Jonathan took charge.

He said that depleting the fiscal buffer the country had built over a decade shifted the subsidy operations from a savings model to a revenue-based approach, forcing the Federal Government to fund the fuel subsidy through crude oil sales instead of ECA funds.

“Between 1999 and 2010, we operated a savings-based subsidy operation. In other words, we were paying for the subsidy from savings. We were not borrowing to pay the subsidy.”

We were simply paying from the Excess Crude Account because we managed our first boom well. I think when former President Obasanjo left office, the Excess Crude Account had over $60bn.

“If you remember, Okonjo Iweala once told us we were broke. And her argument at that time was that a country cannot call spending all its money progress. But something happened, and Jonathan’s government was in a boom. So we moved from a transformative agenda to a Change agenda under President Buhari, and in the first six months of his government, he had concerns with the production of crude oil.

“Shale oil in the US crashed the price of crude oil to less than $22 a barrel, which is lower than the production cost. With this, every oil-producing country automatically entered deficit financing in oil production. Saudi Arabia defended its economy in 2015 with $45bn. But Nigeria didn’t have savings at that time because it had shared the savings among the 36 state governors. So we went into deficit financing in oil production. In other words, we were selling crude at a loss. And we maintained this deficit position for eight years (during Buhari’s regime),” he explained.

Aduloju argued that since 1999, successive administrations in the country have operated different fuel subsidy models, but the poor management of fiscal resources has compounded the financial crisis resulting from the mismanagement of the fuel subsidy.

“The subsidy removal that Tinubu inherited is not the same as the subsidy removal that Buhari inherited, and it’s also not the same as what Jonathan faced. They are different operations. But the consistent issue is that each mismanagement of our fiscal resources by previous governments compounded the problem for the next government,” he stated.

According to him, the biggest challenge under the current administration is not the removal of the fuel subsidy, but the lack of transparency. Until the Federal Government fully examines the financial strain on the economy, there will be no headway.

He said, “When President Tinubu took over, I insisted that what we needed was transparency before choices. Somebody should have first turned on the light and answered the simple question: what are we looking at? What is the size of the fiscal deficit? What were the commitments made in selling crude forward into the future? How much was committed? How much do we owe? How much of our reserves are encumbered?

“Without answering these questions, the policy choice—such as balancing the current account, of which subsidy removal is one option—becomes a facade. And therein lies the problem.”

He emphasized that the fuel subsidy itself isn’t the country’s core issue but rather the lack of transparency, which has created a massive trust gap between the government and the people.

“Subsidy itself is not the problem. The challenge is that the lack of transparency does not allow for choices. Historically, Nigerians have agreed that subsidy is fraudulent. Where they disagree is whether what they would receive after the government removes the subsidy would be of commensurate or greater value. But there is no trust that the government will provide this.

“So basically, there has been a transparency liability. We need to know how much we owe. How deep is the hole? How far does it go? On asset transparency, let’s know which assets are encumbered. I think if we want to make progress, subsidy removal should have been premised on a fiscal baseline. But it wasn’t.”

He said the myriad of economic problems facing the country would be effectively addressed at the upcoming NESG at 30 Summit, which will take place between the 14th and 16th of October, 2024, in Abuja.

Responding, the Acting Editor of The PUNCH, Oyetunji Abioye, who led the company’s team to receive the visitors, said the vision of NESG aligns with that of The PUNCH, and the company would offer its strong support for the upcoming summit, beginning with its press conference slated for Friday (tomorrow).

The NESG team included the Chairman of the Media and Publicity Subcommittee for the 30th NESG Summit, Mr Udeme Ufot; NESG Senior Communications Specialist, Francis Jakpor; NESG Associate, Oluwatobi Abodunrin; and Executive Assistant to the NESG CEO, Biodun Shittu.