The Nigerian cattle trade and consumption markets are characterised by absurdities which pose grave threats to the business, incidentally perpetrated by the largest consumers of beef in the country.

Disturbed by the situation, cattle traders and transporters from the North East have raised the alarm over, heavy taxes imposed on them on the various states’ roads en route the South East and South South markets in the country.

Most of the traders and transporters interviewed by Weekend Trust revealed that the ‘crushing’ taxes are very frustrating and could eventually obliterate the cattle trade if left unchecked.

@media only screen and (min-width: 992px){#div-vi-1716478739{width:728px !important;height:90px !important}}

In an interview with our correspondent, most of the truck/trailer drivers plying the South East and South-South roads revealed that they spend between N900,000 to N1.2 million per cattle trailer on the road before accessing markets in the South East and South South.

They all identified roads in Benue, Cross River, Ebonyi, Abia, Imo, Rivers, Bayelsa, Enugu, Anambra, Edo and Delta states, as where traders suffer high instances of arm twisting, and outright extortion, in the hands of the tax/revenue collectors.

One of the drivers, Isah Dogo, said he has spent over 15 years conveying cattle to the eastern part of the country, adding that the extortion has always been there, and is only getting worse.

“These ‘extortion racketeers’ would block the road and enforce authority on us, extorting us with impunity, and nothing has been done about it.

“Most times, they operate very close to security checkpoints,” he added.

Another driver, Sani Bush, said they prefer avoiding Benue State, following even longer routes through Kano, Kaduna and Abuja to escape the touts.

“We pay outrageous taxes – a large per cent of them illegal to touts. We are told that most of the money ends up in their pockets. It’s now a standard that for any trailer to ply that road, the trader must part with at least N1 million to the touts,” he said.

In Port Harcourt, a cattle dealer, who is also a community leader, Alhaji Muhammad Uba, said the issue of illegal tax collectors in the region has lingered for decades.

“The federal government tried to take action but the Nigerian problem is hydra-headed. These touts have become authorities on their own. They stop you, charge you any amount they feel like and if you don’t give them, they destroy your vehicle.

“For that, every driver must stop at their roadblocks and pay whatever they demand, not because it’s lawful but to avoid being molested.

“You can’t risk something of N30 million because of N300,000 even if it is demanded by unauthorised collectors. They are stationed miles away from each other and would break your windscreen or puncture your tyre in the middle of the bush if you argue with them. It is daylight robbery.

“In each of these states – Abia, Ebonyi, Delta, Benue, etc – you come across not less than five roadblocks manned by these boys, sometimes only meters away from security checkpoints.

“They wield clubs at you, and force you to stop in the middle of the bush; there’s nothing you can do,” he said.

Uba said there was a time, during Buhari’s administration, that the tax racketeering was banned several times, but has continued to resurface.

“The federal government has gazetted everything about their activity but they have so far proved unstoppable, not even by the government.

“These highway extortions have been lingering just like cankerworm of corruption in the country and we have to adjust ourselves to live with it. That’s just it,” he lamented.

The chairmen, Cattle Dealers Associations, from the northern and southern parts of the country corroborated that a cattle trailer pays between N900,000 to N1.2 million to access the South East and South South.

Alhaji Muhammadu Mijinyawa, chairman of the Cattle Dealers Association, Akwa Ibom chapter, said the tax collectors present themselves as third-party agents of state or local governments to collect huge amounts of money from traders and truck drivers.

“Traders transporting cows to this region encounter multiple tax challenges. For example, when transporting cattle from Adamawa to Akwa Ibom, we spend N1.2 million as tax per trailer.

“A tout will tell you to pay N45,000 as revenue, or else he will deflate the truck tyres or break the windscreen and assault the driver. All this must be added to the cost of the cows.

“You find them operating freely in Benue, Cross River, Ebonyi, Abia, Imo, Rivers, Bayelsa, Enugu, Anambra, Edo, and Delta states,” he said

He recalled how a former Inspector General of Police, Mohammed Adamu, had once drafted a team of police to enforce the court order after their association won a court case on multiple taxations.

“Unfortunately, we couldn’t make any arrests because we later discovered they had informants within the police and even some of our people (traders).

Touts fleece cattle dealers N65m daily, N23.7bn annually – Records

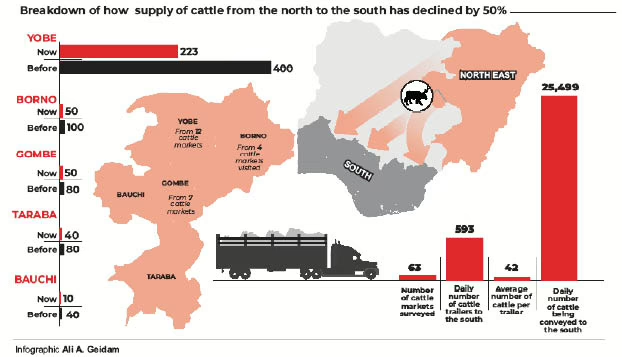

Meanwhile, a survey conducted by Weekend Trust in 63 cattle markets across the North East region revealed that over 593 cattle trailers move down to the southern part of the country every day.

But, records from five states of the South East and South South showed that they usually receive 65 trailers loads of cattle daily; 455 per week; 1,950 per month; and 23,725 per year.

Therefore, on an average of N1 million tax per trailer, the cattle traders are paying N65 million per day, N445 million per week; N1,950 million per month and N23,752 billion per annum.

Breakdown of the supply of cows

Port Harcourt receives 20; Akwa Ibom 15; Warri, Enugu, Abia 10 trailers each, daily.

According to Alhaji Muhammad Uba, a cattle dealer in Port Harcourt, they receive 20 trailers of cows every day from the North.

“Our slaughterhouse in Port Harcourt alone, on average, processes about 250 cows in a day, while the smaller slaughterhouses handle 40 to 50 cows per day.

“If you multiply the number of cows we slaughter per day, you will realise that we slaughter between 10 to 20 trucks every day in Port Harcourt and environs,” he said.

He said the number of cattle trailers going to the South East states is just about the same as that of Port Harcourt.

“We have another slaughter market in Abia State, at Lobanta, that takes care of all the eastern states. In fact they now slaughter an average of 20 trucks, against 30 to 40 in the past.

“And here in the South South, we have another slaughter market at Warri in Delta State and Benin in Edo State.

“Most of the towns across Delta State rely on the Warri cattle market.

“Then Cross River State, in Calabar and Uyo, has another cattle market, where a large number of cows are brought every week,” he said.

The chairman, Cattle Dealers Association in Akwa Ibom, Alhaji Muhammadu Mijinyawa said they also receive at least 15 trailers of cows on a daily basis.

“Based on my records, from January to December 2023, Mijinyawa said, they receive 750 trucks of cattle. So on average, if you divide them by 52 weeks you will have 15 trucks per day.

“Each truck has the capacity to carry between 30 and 40 cattle. So, on average each truck is carrying 32 units of cows.”

On the number of cows being slaughtered daily in the state, he said “They slaughter 448 cows, and in Uyo alone, they slaughter between 40 and 50 every day, and the 400 outside the state capital. They have a larger population in villages than in the city. Places like Eket, Oron, Ikot Abasi, Ikot Ekpene etc,” he said.

Extortions continue despite court injunction

Alhaji Audu Lalega, Chairman, Miyetti Allah, Lagos State, said they spent eight years in a legal battle with the federal government over the multiple taxation on trunk A highways.

“We won it at last; now we only pay tax at the points of loading in the North and offloading here in the South. We no longer pay anything on the road from the Northeast down to Lagos, same with the states of the South West.

“Unfortunately, things have not changed in the South East and South South. Any cow dealer transporting cattle to these regions must at least spend N1 million on thugs and security checkpoints before they reach Enugu, Akwa Ibom, and other states in the region,” he said.

He blamed the government for not enforcing the court order and compromise on the part of security operatives manning the roads.

“We had a 7-year legal battle with the federal government before we were relieved from illegal taxes on trunk A roads,” he said.

AUFCDN laments excessive taxation

Also, the cattle traders, under the auspices of the Amalgamated Union of Foodstuff and Cattle Dealers of Nigeria (AUFCDN) have continuously claimed that while the southern markets have the higher chunk of the about 400,000 tons of meat consumed in the country, the traders suffer excessive taxation along their roads, most especially, the South South and South East routes while transporting the animals there.

The national president of the union, Mohammed Tahir, was reported last February to have expressed the most noticeable complaint about the situation at a meeting of the stakeholders of the trade in Enugu.

“Our members are mandated to pay taxes at loading and off-loading points, a practice observed in the South West and the North. However, those transporting foodstuff and cattle from the North to the South South and South East regions encounter numerous challenges, including multiple taxations,” Tahir reportedly said.

He complained further: “For example, when travelling from Maiduguri to Lagos, there are no such challenges. After paying taxes at the loading point in Maiduguri, no additional taxes are incurred until reaching Lagos.

“However, travelling to the South South and South East from Maiduguri involves encountering challenges in states like Benue, Cross River, Ebonyi, Abia, Imo, Rivers, Bayelsa, Enugu, Anambra, Edo and Delta.”

Cattle traders, grappling with the increasing challenges posed by the worsening economic hardships, have continued to complain of the problem which, they cry out, is choking them evermore out of the North-South business.

They are particularly perplexed by the sharp contrast between the high percentage of consumption and what they have continued to describe as the crushing taxation in the southern states.

Benue clampdown on illegal tax collectors

Speaking to journalists in Makurdi, the Acting Chairman of Benue State Internal Revenue Service, Emmanuel Agena, said 35 people engaged in illegal tax collection in the state are facing prosecution.

The BIRS acting boss, who lamented the activities of illegal tax collectors in the state, noted that most of them had the backing of prominent individuals.

He frowned at the recent incident where a truck conveying palliatives from Adamawa to Anambra State was hijacked by some youths in Aliade, Gwer East.

He said, “A truck was intercepted and the driver beaten while the windscreen of the vehicle was broken and over N200,000 was stolen. Three persons have been arrested and are in police custody. They will be moved to DSS for a thorough investigation.

“We aim to flush out or reduce illegal tax collectors to the barest minimum. Already, 35 people who engaged in illegal tax collection were arrested and are facing prosecution.

“This has been a big challenge. We have constituted a team headed by the director of tax collection. Prominent people in the state are involved in encouraging these boys,” he added.

According to the BIRS boss, the agency planned to recover over N5.6bn from ground rent, adding that it was liaising with the state’s ministry of land in that regard.

“We also engaged the services of Softnet, an ICT company, to aid us in collecting revenue. They are paid a commission. The company has engaged over 250 staff, who have been trained and given Point on Sale to collect revenue.

“Taxation is about confidence. Our work now is easy because taxpayers are willing to pay as the people are seeing what the government is doing,” he stated.

Fintiri frowns at cattle trade obstacles, says 29m livestock leave Mubi for Lagos

On December 30, 2024, Governor Ahmadu Umaru Fintiri of Adamawa State, who received the Minister of Livestock Development, Alhaji Idi Mukhtar Maiha, called for action to save the livestock sector, which he said is critical to nation-building.

The governor urged the federal government to remove obstacles hindering the livestock trade, such as roadblocks and extortion of cattle traders on the highways.

He commended President Tinubu for creating the ministry and appointing Idi Maiha as minister, describing it as one of the biggest decisions the government has ever made.

Governor Fintiri expressed confidence in the minister’s ability to deliver on his mandate, citing his intellect and capacity to revitalise the sector.

The governor highlighted Adamawa State’s significant contributions to the livestock industry, with 29 million livestock leaving Mubi for Lagos and generating N29 billion from the Mubi market alone.

He emphasised the state’s commitment to developing the agriculture sector, leveraging livestock and accessing loans from capital markets.

Governor Fintiri also revealed plans to build modern abattoirs and cattle hubs in the state, in collaboration with investors.

He commended the minister’s initiative in introducing technology to track cattle rustling, a move that will help address security challenges in the country.

Earlier, Maiha acknowledged Adamawa State’s rich animal resources and thanked the governor for the warm reception.

He commended the governor’s foresight in building a northern international cattle market in Mubi and praised the state’s urban infrastructure.

Maiha emphasised the federal government’s commitment to leveraging the livestock sector’s potential for the country’s benefit, highlighting the country’s 415 grazing reserves, with Adamawa State boasting over 33 of them.

Update: In 2025, Nigerians have been approved to earn US Dollars as salary while living in Nigeria.

Click here to learn how it works.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.